Learn about Port of Los Angeles Investor Relations including our Environmental Program and Green Bonds, News & Press Releases, Projects, and Team.

Talk to us

Have questions? Reach out to us directly.

Learn about Port of Los Angeles Investor Relations including our Environmental Program and Green Bonds, News & Press Releases, Projects, and Team.

About the Port of Los Angeles

- Bond Ratings

- AA+/Aa2/AA

- FY 2025 Cargo Volume

- 10.52 million TEUs

- Bonds Outstanding as of September 2025

- $261.515 million

The Port of Los Angeles, America’s Port® and the premier gateway for international commerce, is located in San Pedro Bay, 25 miles south of downtown Los Angeles. This thriving seaport not only sustains its competitive edge with record-setting cargo operations, but is also known for groundbreaking environmental initiatives, progressive security measures, diverse recreational and educational facilities, and emerging LA Waterfront.

The Port of Los Angeles encompasses 7,500 acres of land and water along 43 miles of waterfront. It features 27 passenger and cargo terminals, including automobile, breakbulk, container, dry and liquid bulk, multi-use, and warehouse facilities that handle billions of dollars’ worth of cargo each year.

Complementing its busy terminal operations with green alternatives, the Port of Los Angeles remains committed to managing resources and conducting developments and operations in both an environmentally and fiscally responsible manner. The Port of Los Angeles has embarked on a 10-year, $2.6 billion infrastructure investment program and will to continue to raise the bar to increase efficiency. The Port remains committed to modernizing its facilities and helping to create better information flow for stakeholders via technology.

With an exceptional credit record, the Port maintains AA+/Aa2/AA bond rating, the highest rating attainable for self-funded ports. The Port also wields tremendous economic impact, generating employment for more than 3 million Americans nationwide. In California alone, nearly 1 million jobs are related to trade though the Port of Los Angeles.

Against the backdrop of international trade and shipping, the Port of Los Angeles boasts the World Cruise Center, welcoming Vincent Thomas Bridge, signature Fanfare Fountains & Water Features, historic Angels Gate Lighthouse, and open green space at 22nd Street and Wilmington Waterfront parks. The Port is also home to two historic U.S. warships open to the public: Battleship IOWA and SS Lane Victory Merchant Marine Museum and Memorial. Joining the LA Waterfront are WWII-era warehouses that have been transformed into CRAFTED at the Port of Los Angeles, a permanent craft marketplace, featuring local artists and designers, and Brouwerij West, a Belgian-style craft brewery.

Image Gallery

Environmental Program and Green Bonds

Please see below for information regarding the Port of Los Angeles’ Environmental Program and Green Bond Issuances

News

Pact Accelerates Zero-Emission Technologies at Port of Los Angeles, Port of Long Beach, Delivers Cleaner Air and Supports Healthier Communities

Nov. 20, 2025 – The Los Angeles Board of Harbor Commissioners has unanimously approved an agreement with the South Coast Air Quality Management District (South Coast AQMD), Port of Los Angeles and Port of Long Beach to accelerate development and implementation of zero-emission technology and infrastructure at both ports. The cooperative agreement covers all major port emission source categories, including cargo handling equipment, harbor craft, trucks, trains and ocean-going vessels.

“The passage of the Cooperative Agreement is just one way we are continuing our historic efforts to create a cleaner, more sustainable city, including the Port of Los Angeles,” said Mayor Karen Bass. “By working together with our partners at South Coast AQMD and the Port of Long Beach we will continue to build upon this moment, achieving our shared goal of cleaner air, healthier communities, and a more climate resilient future for all.”

Approved by the South Coast AQMD and the Port of Long Beach earlier in November, the agreement calls on both ports to develop comprehensive zero-emission infrastructure plans in three phases, starting with a draft plan in May 2027. Approved plans for all emission categories are required under the agreement by the end of 2029.

“This Cooperative Agreement represents an important step toward creating clean, breathable air for our local communities and I am committed to making sure we hold ourselves accountable to the proposals set forth,” said Los Angeles City Council member and South Coast AQMD Board Member Nithya Raman. “Continuing a decade of inaction on this issue is simply not an option, and I am grateful to everyone who participated in the conversation to move this zero-emission legislation forward.”

“This Cooperative Agreement gives our Port and tenants the flexibility to address the many complex challenges inherent in transitioning to zero-emission technology and infrastructure, while also ensuring accountability and transparency,” said Los Angeles Harbor Commission President Lucille Roybal-Allard. “Our greatest appreciation to the South Coast AQMD, the Port of Long Beach and the many stakeholders who we are partnering with on this transformative initiative.”

“We look forward to this new era of collaboration between our ports and the South Coast AQMD as we work together toward a zero-emission future,” said Port of Los Angeles Executive Director Gene Seroka. “This action represents a balanced, results-driven approach to developing the infrastructure necessary to continue reducing emissions at the San Pedro Bay ports.”

The South Coast AQMD will verify progress on both ports’ infrastructure plans through annual reports and regular reporting to its Governing Board. Penalties for noncompliance by the two ports range from $50,000 to $200,000 per default, with penalty fees going toward projects benefiting near-port communities.

The new agreement builds on the success of the two ports’ Clean Air Action Plan (CAAP), a voluntary and unprecedented air quality program approved in 2006. Since that time, the Port of Los Angeles has cut overall emissions of diesel particulate matter (DPM) by 90%, sulfur oxides (SOx) by 98% and nitrogen oxides (NOx) by 73%. For every 10,000 containers, emissions of DPM, SOx and NOx are down 93%, 99% and 81%.

Both ports are also continuing to work with South Coast AQMD on adding new CAAP measures to reduce emissions from oceangoing vessels, the largest source of emissions at the ports. The South Coast AQMD Board expects to review these new “CAAP-Plus” measures sometime in Spring 2026.

Plan Funded $400 Million in LA Waterfront Projects, Community and Educational Programs Over Last Decade

April 24, 2025 – Alongside record-setting cargo volume, the Port of Los Angeles has invested more than $400 million in LA Waterfront projects, initiatives and education programs over the past decade through its Public Access Investment Plan (PAIP). Celebrating its 10-year milestone, the Port continues to invest 10% of its operating income back into the harbor communities of Wilmington and San Pedro.

“I’m so excited about the work that we’re doing with the Public Access Investment Plan, and the fact it is a community grassroots effort,” said Port of Los Angeles Executive Director Gene Seroka. “As this Port thrives, we are able to invest more into the community. And when we have this great community pulling in the same direction…the sky is the limit.”

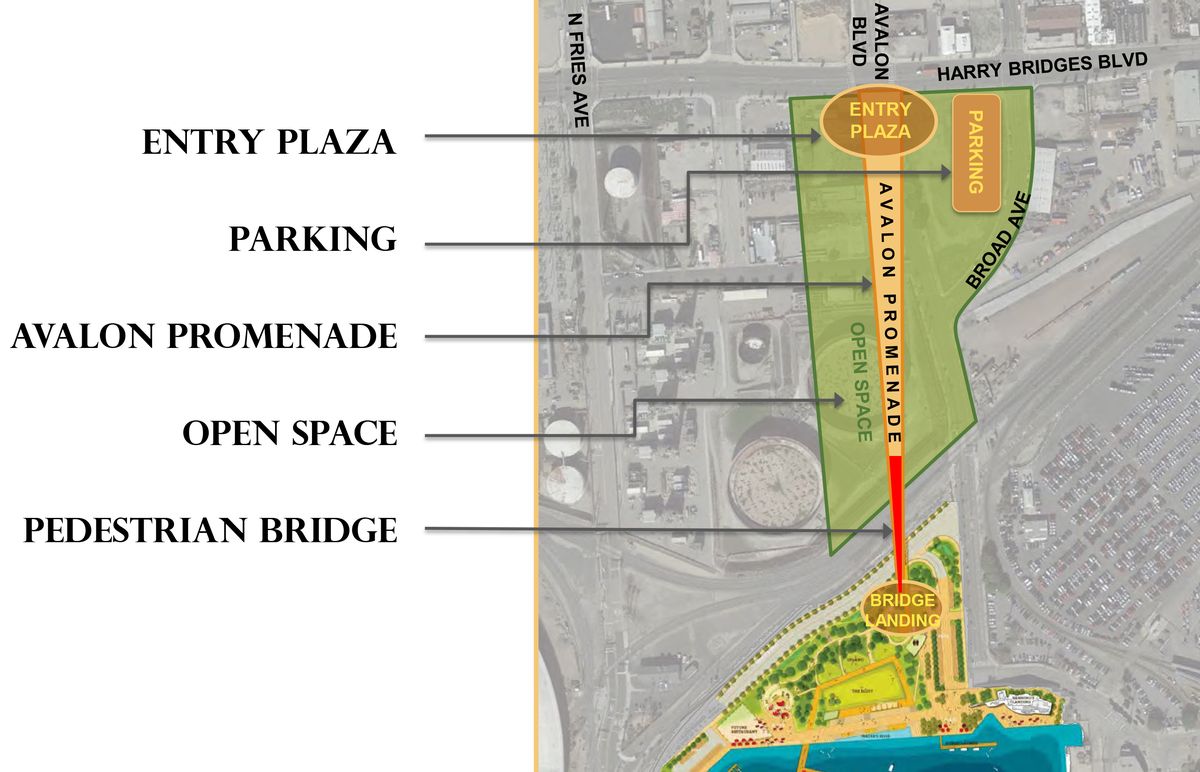

“The Public Access Investment Plan took projects that the Port had on our capital project list and made them a reality,” said Port Director of Waterfront and Commercial Real Estate Mike Galvin. “We have been able to build out streets and promenades that bring more visitors and accessibility directly to the water’s edge.”

When established in 2015, the PAIP created a direct link between the Port’s cargo success and community investment; provided more predictability and transparency for planning long-term public access projects; and ensured the long-term maintenance, programming and activation of the LA Waterfront. The PAIP also instituted a planning process that incorporated extensive community input on projects to be built.

LA Waterfront projects recently completed under the plan include the Wilmington Waterfront Promenade, San Pedro Town Square and Promenade, in addition to several road improvements and realignments to facilitate access to West Harbor, which is expected to open to the public in 2026.

Over the next decade, the Port plans to allocate another $400 million to fund additional public access projects, maintain existing projects and provide public benefit programs. Later this year, the Port plans to announce a host of new public access projects, identified with support from City Councilmember Tim McOsker and other community stakeholders, slated for development within the next five years.

Agreement Focuses on Building Skills and Career Pathsin Goods Movement Industry, Environmental Stewardship

Feb. 4, 2025 – The Port of Los Angeles and the California Community Colleges Chancellor’s Office have signed an agreement to collaborate on initiatives to better prepare community college students for careers in the evolving goods movement industry. The Memorandum of Understanding (MOU) brings together the resources of America’s busiest container port with a college system that is the largest provider of workforce training in the nation.

The MOU focuses on critical issues facing the maritime industry, including zero-emission operations, decarbonization, environmental stewardship and changing technologies.

“The California Community Colleges Chancellor’s Office partnership with the Port of Los Angeles, a large employer in the region, will help position our colleges to support students for good jobs and careers in the climate economy,” said California Community Colleges Chancellor Sonya Christian. “This collaboration exemplifies Vision 2030’s focus on Workforce and Economic Development recognizing that employer engagement is an essential component.”

“The goal of this MOU is to provide students with the education, skills and pathways they’ll need for future careers in our industry,” said Port of Los Angeles Executive Director Gene Seroka. “The impetus behind this partnership is to ensure that our local colleges remain up to date with changing technologies, and that students are prepared for future job opportunities as our industry evolves.”

Partnership activities outlined in this MOU include:

• Collaborating on how to create career path opportunities for community college students

• Improved job-seeking processes for community college students and alumni, especially in high-demand job categories

• More opportunities for community college students to participate in user experiences and research activities

• Port informational sessions at community college career centers

• Providing Port experts for career and recruitment fairs on community college campuses

The agreement builds on the Port’s ongoing efforts to promote workforce development and build clear connections between skills learned in today’s colleges with the skills in demand by employers in the goods movement industry. In November 2024, the Port and UCLA signed an agreement to foster collaborations with neighborhoods and communities around the Port, and create new learning, research and workforce opportunities for UCLA students and faculty.

Other workforce initiatives underway at the Port include the opening of a new $16 million International Longshore and Warehouse Union (ILWU)-Pacific Maritime Association (PMA) Maintenance and Repair Training Center on Terminal Island, offering programs to reskill and up-skill ILWU workers. The Port of Los Angeles, Port of Long Beach, ILWU, PMA and California Workforce Development Board are also in the process of building a 20-acre training facility. When completed, it will be the only workforce training center in the U.S. dedicated solely to the goods movement sector.

Projects

Team

Gene Seroka

Jeffrey Strafford

Matthew Marchese

Phillip Sanfield

Carol Wang

Talk to us

Have questions? Reach out to us directly.